We Want to Help

No matter the reason that your primary home has been damaged, Close to Home wants to help you continue to live in your current community as you recover and build back the life that you had. We want to help you continue to be connected to your family, friends, schools, church, workplace, etc. – and to do so by providing you with temporary housing – potentially right on your own lot.

During the recovery phase, utilities are working and reconstruction of homes and community buildings has begun. This is the time when you could potentially live on your property in a temporary house as the rebuild of your home is under way.

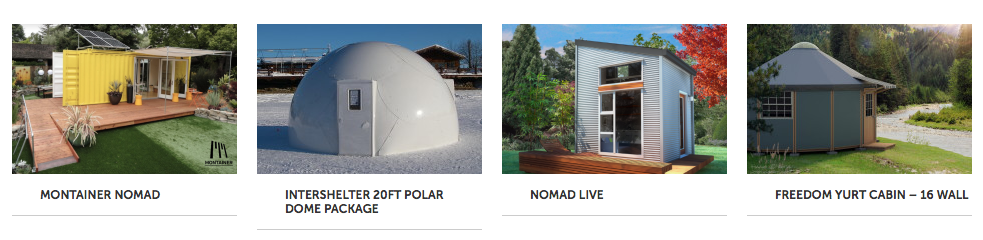

We provide housing options that will allow you to live on your lot, in your own community as you navigate the road to recovery. We want to advocate on your behalf. Instead of renting a home far away from your community – our housing solutions keep you close to home.

If you have insurance, you should have a “loss of use” rider that will pay for your temporary housing until you can move back into your primary residence. Call us to help you advocate for the right to live in one of our housing products – right on your own land. We will help you to work with your insurance company.

Loss of Use Coverage

According to the American Insurance Association, loss of use coverage “generally provides protection when a residence cannot be lived in because of an insured loss. Coverage terms vary among insurers, and it is important to review your policy and call your insurer or agent with any questions. The three coverages are called: 1) additional living expense, 2) fair rental value and, in most states, 3) prohibited use. The limit of liability for loss of use shown on the declarations page is the total aggregate limit for these three benefits.”

“Additional Living Expense – If a covered loss results in the residence premises being unfit to live in, the insurer will cover any necessary increase in living expenses to allow the household to maintain its “normal standard of living.” The payment will be for the least amount of time necessary to repair or replace the damage or, if the named insured has to permanently relocate, the least amount of time required for the household to settle at another location.”

The American Insurance Association goes on to provide the following example:

“…assume a house has been partially damaged in a fire. Because of the extensive damage, the policyholder is forced to move to a rental apartment on a temporary basis. Their rent is $1,400 per month, which is in addition to the policyholder’s $1,100 mortgage payment, which she will continue to pay. Thus, the $1,400 in rent would be considered additional living expenses. If the policyholder’s food costs averaged a little higher than they were before the fire, this additional amount would be covered as well.”

Source: American Insurance Association

4 Walls & A Roof... Plus Community

In the end, it’s all about people. At Close to Home we recognize the power of community – the power of staying in one’s original community as you organize, communicate, figure out what the path to recovery looks like. It’s hard to do all of that work if you are renting a home in another town.

We recognize that the quicker that more folks can return home, the quicker that you can get back to living your life. We hope that our housing products can play a vital role in that recovery.